Understanding Fraud – The Fraud Triangle and More

Typical organizations lose five percent of revenues each year to fraud. As reported before, hotlines increase chances of catching fraud. It is obviously important to detect fraud, often enabled through hotline tips; the sooner fraudulent behavior is detected, the more likely fraud-related losses can be minimized. It is arguably more important but even more difficult, to deter and prevent fraud. To deter or prevent undesirable behavior one must understand what motivates it. The fraud triangle and the fraud diamond are models that help boards of directors, ethics officers, fraud investigators, and others to understand what motivates people to commit fraud.

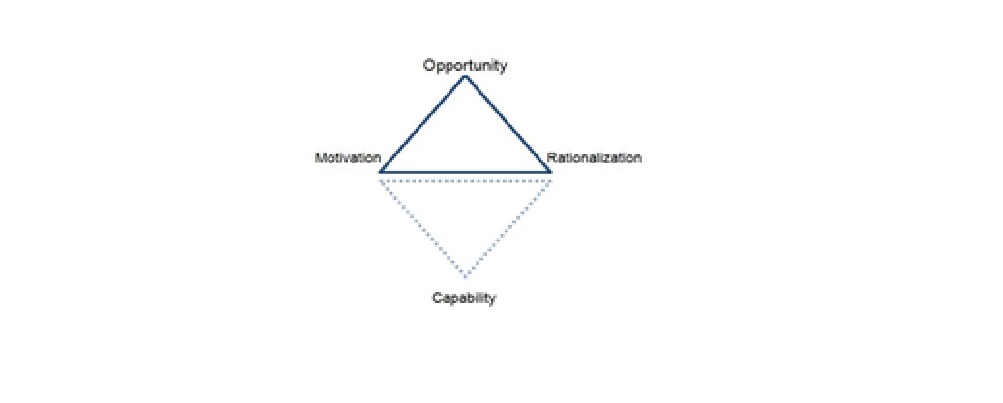

The fraud triangle model, which is based on work by Donald Cressey and Edwin Sutherland, has been used since the 1950s. Elements of the triangle include perceived pressure (such as the need to meet financial targets), opportunity (poor checks and balances or weak systems), and the ability to rationalize the fraud.

As reported by Steve Albrecht in a July/August Fraud Magazine article, Cressey described people who commit fraud as follows: “Trusted persons become trust violators when they conceive of themselves as having a financial problem that is non-sharable, are aware that this problem can be secretly resolved by violation of the position of financial trust, and are able to apply to their contacts in that situation verbalizations which enable them to adjust their conceptions of themselves as users of the entrusted funds or property” (Albrecht, 2014). In other words, they have motive, they have opportunity, and they are able to rationalize their actions.

The fraud triangle model has been used for decades to help understand what causes people to commit fraud. However, it has limitations, as summarized by Jack Dorminey and others in a September/October 2011 Fraud Magazine article. They report that professionals and academics in the field have extended the fraud triangle to make it more useful. Some of the extensions:

Converting the triangle model to a diamond by adding an assessment of capability (a more observable attribute than either motivation or rationalization, although both of those remain key to understanding fraudsters.)

Exchanging “integrity” for rationalization, which, as stated above, is not easy to observe. Integrity can be deduced by observing a person’s decisions and decision-making process.

Recognizing that pathological fraudsters need only opportunity; perhaps their motivation is “because they can”, and perhaps they have no moral compass requiring rationalization.

Broadening the understanding of motivation to include not just money, but also ideology, coercion, and ego (mICE.)

Focusing not just on individual opportunity but also on collusive behavior and “management override.”

The fraud triangle, fraud diamond, and mICE models all serve as aids in understanding how and why people commit fraudulent acts or engage in other undesirable behaviors. That understanding can help organizations take action to deter and prevent fraud, and to develop training and awareness to help all employees detect the warning signs.

Ethical Advocate provides comprehensive ethics and compliance solutions, including confidential and anonymous hotlines and training on fraud awareness, business ethics, haraasmnt and discrimination, the Foreign Corrupt Practices Act, and more.

References:

Albrecht, W. Steve. “Iconic Fraud Triangle Endures: Metaphor Diagram Helps Everybody Understand Fraud.” Fraud Magazine, July/August 2014.

Dorminey, Jack W. et al. “Beyond the Fraud Triangle: Enhancing Deterrence of Economic Crimes.” Fraud Magazine, September/October 2011.